The payment is to be made upon submission of the income tax return form for the relevant YA if there is any balance of taxes to be paid. Download Form - Other Forms.

If you are running digital advertising campaigns in Malaysia specifically on Google Facebook or LinkedIn you might want to pay attention to the Withholding Tax WHT.

. Will taxpayers who are eligible for the deferment of CP204 and CP500 payments be required to settle the deferred payments all at once after the deferment period ends. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. The first accounting period ended on 31122019 9 months.

Instead of the standard 10 WHT required for royalty you just need to factor in 8 WHT for royalty payment to Singapore and Ireland under the Double Taxation Agreement DTA scheme for Google LinkedIn billed. Was established on 2522019 and commenced business operation on 142019. Headquarters of Inland Revenue Board Of Malaysia.

The company must submit e-CP204 for the Year of Assessment 2019 not later than 3062019 which is three 3 months from the date of commencement of its business operations.

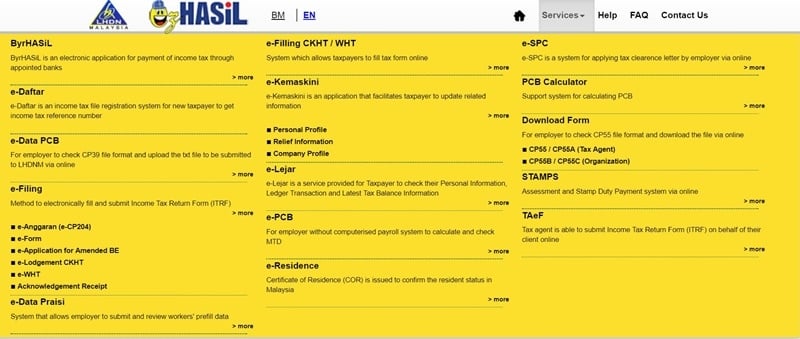

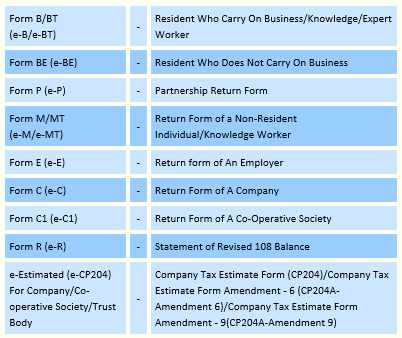

What Is Cp204 Cp204 Vs Cp204a Sql Payroll

Cp204 Form Fill Online Printable Fillable Blank Pdffiller

St Partners Plt Chartered Accountants Malaysia Sme Notification From Lhdn For Deferment Of Cp204 Payment From April To June 2020 Recently Lhdn Has Send Out Email To Notify The Deferment

Faqs On The Deferment Of Payment Of Cp204 And Cp500 Ey Malaysia

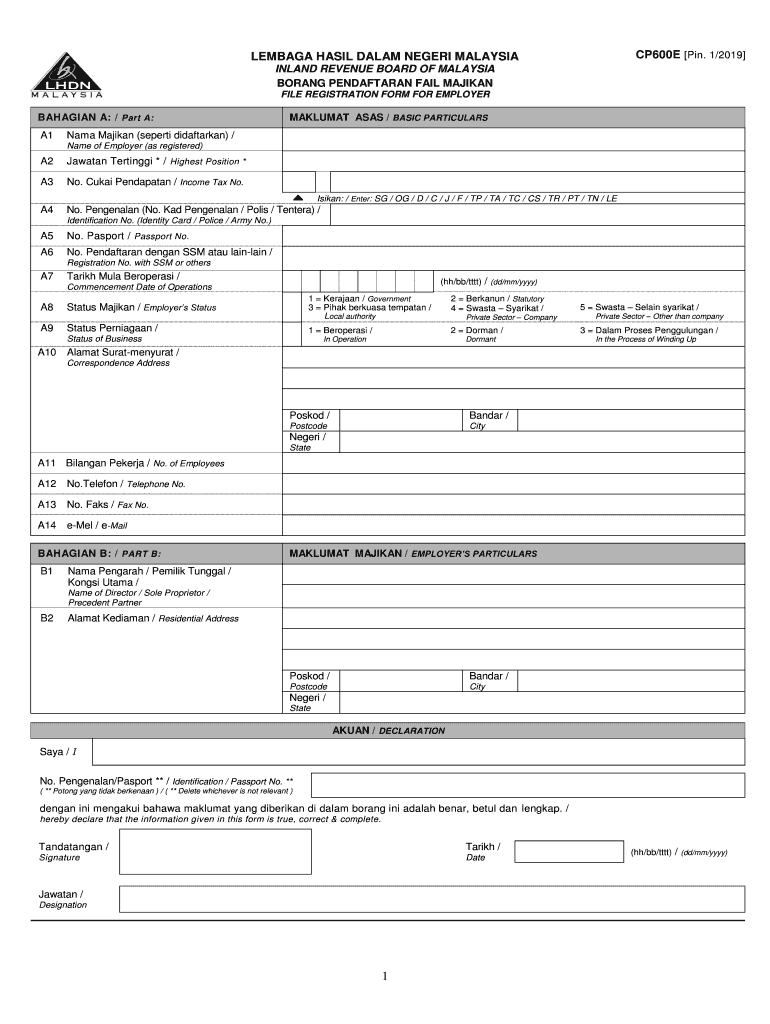

2019 2022 Form My Cp600e Fill Online Printable Fillable Blank Pdffiller

Deferment Of Cp204 Payment Budget 2022

What Is Cp204 Cp204 Vs Cp204a Sql Payroll

Cp204 Form Fill Online Printable Fillable Blank Pdffiller

Taxplanning Tax Measures Announced During The Mco The Edge Markets

Cp204 Form Fill Online Printable Fillable Blank Pdffiller

Cp204 Form Fill Online Printable Fillable Blank Pdffiller